- What we do

-

-

Digital Engagement Banking

CBX is built to enable banks to run lean, experiment, and operate with speed and agility while focusing technology resources on innovation.

Products

Combining products for fulfilling holistic needs of the customer.

Platforms

Combining products, solutions and capabilities from multiple providers.

Banking As A Service

Embed services within a customer’s ecosystem, and reshaping consumption patterns of end customers.

-

-

-

- Company

-

- Knowledge

-

- Contact Us

News Flash

National Bank of Kuwait (NBK) expands partnership with Intellect Global Transaction Banking

Read Full PR News FlashiGTB's CTX Platform Successfully Deployed by a leading European Bank in France

Read Full PR News FlashiGTB Pulse Newsletter February 2024

Read More News FlashHighlights of Transformation Strategies for Transaction Banking in Philippines & Thailand

Know More News FlashThe Perfect Storm - Opportunities and Threats on the Horizon

Read More

Contextual Cash Flow Forecasting

3 Mins

Contextual Cash Flow Forecasting

Transform a chore taking your clients hours into something beautifully simple taking minutes. Build a cash balance forecast based on categorised payables and receivables.

Clever use of machine learning highlights likely upcoming payments adding to the data the bank already has plus corporate data. The forecast becomes an important insight, making the bank a more used and more trusted resource.

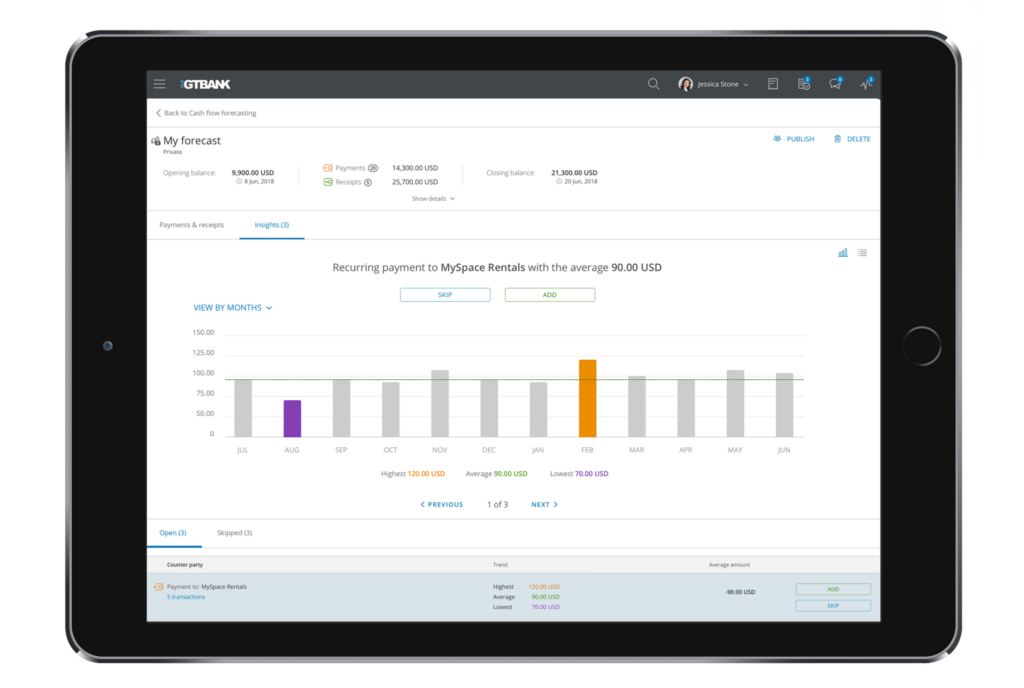

Automatic Forecasting

Detect patterns in previous movements to predict upcoming items

- Let the system highlight repeated payments or receipts

- Visualise the amounts, dates and see the periodicity, average, highest and lowest amounts

- What is needed to enable a good BaaS solution?

- Or refine the forecast by adjusting the automatic predictions based on the treasurer’s superior knowledge

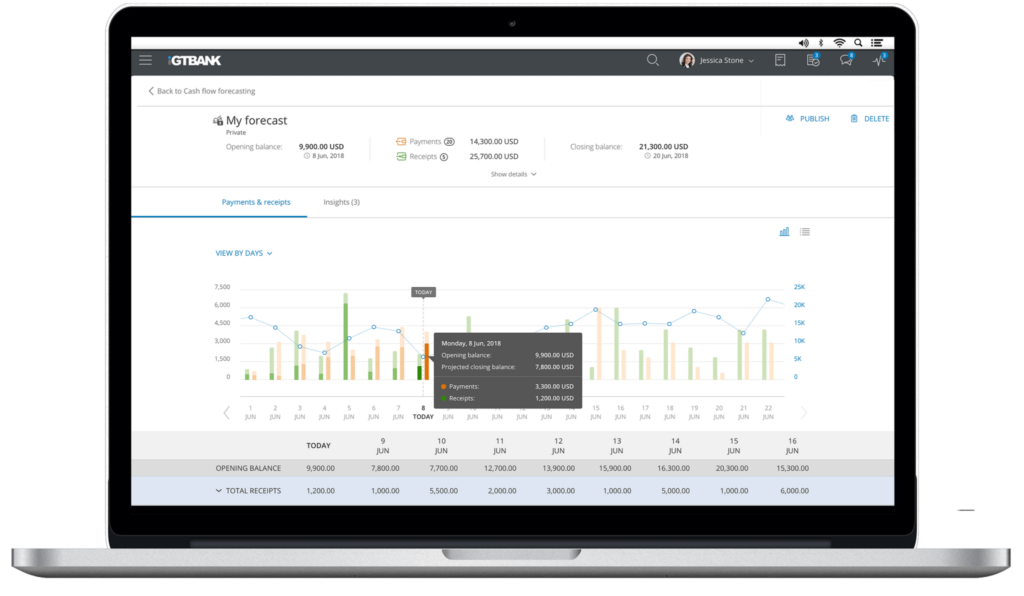

Powerful Visualisation

At-a-glance view of near future cash

- Graphical view of past, current and future

- Shows daily incomings, outgoings as well as resultant balance

- Summary highlighting movement totals and opening and closing position during the period

- Shortfalls and surpluses are handled clearly and simply

All the Detail at your Fingertips

Scrolldown tabular view to provide full information

- Incomings and outgoings listed by date

- Outgoings categorised as desired by the corporate, for example investments, loan repayments, purchases, salaries, tax

- Incomings also, eg sales, dividends, interest, refunds

- Drilldown by click to full transaction detail

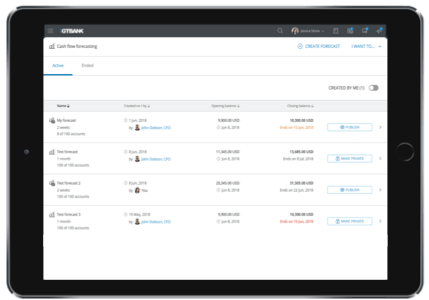

Powerful but Easy Forecast Management

Create and manage multiple forecasts for a fully personal, intimate, rich view of the future with various what-ifs

- Create a forecast in minutes not hours with a click or two

- Choose the accounts to forecast and length of time

- Give it a unique name and add notes to keep track

- Keep the forecast private or share it amongst colleagues

- Forecasts are fully included if desired in entitlement workflow

- The forecast automatically deactivates after its end date

Crack the Data Acquisition Problem

Data is collected from multiple sources

- APIs are fully supported and the purest way

- File upload and connection to online apps (eg Quickbooks) all supported

- Manual input and adjustment also possible

- Export to Excel, csf and similar formats

A Win for the Bank as well as for the Corporate

A powerful way to increase customer stickiness at zero operational cost

- Zero effort on operations needed by the bank

- Can easily be integrated into the bank portal

- Encourages the client to share past, current and future payment and receipt data with the bank enabling greater intimacy

- Helps increase client stickiness, greater use of the bank portal and more likelihood to become principal, revenue-earning bank

Ask Your Questions to Our Expert

Lorem ipsum dolor sit amet Lorem ipsum dolor sit ametLorem ipsum dolor sit amet

Similar Blogs

Frequently Asked Questions

Lorem ipsum dolor sit amet Lorem ipsum dolor sit ametLorem ipsum dolor sit amet

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.