- What we do

-

-

-

-

"Intellect’s continued dominance at the IBSi Sales League Table underscores its pioneering role in the fintech industry. Their commitment to innovation, exemplified by the groundbreaking eMACH.ai platform, continues to set a high benchmark in Retail Core Banking, Transaction Banking, and Lending. Intellect’s solutions are not only reshaping the present landscape but are also poised to lead the evolution of financial services globally, driving unprecedented advancements and customer-centric solutions."

Robin Amlôt

Managing Editor at IBS Intelligence

-

-

-

- Company

-

-

-

-

"Intellect’s continued dominance at the IBSi Sales League Table underscores its pioneering role in the fintech industry. Their commitment to innovation, exemplified by the groundbreaking eMACH.ai platform, continues to set a high benchmark in Retail Core Banking, Transaction Banking, and Lending. Intellect’s solutions are not only reshaping the present landscape but are also poised to lead the evolution of financial services globally, driving unprecedented advancements and customer-centric solutions."

Robin Amlôt

Managing Editor at IBS Intelligence

-

-

-

- Knowledge

-

- Our Events

- Contact Us

Your Blueprint to Payment Modernization – Omdia Universe Payments Hub report 2024

Read More News FlashThe Evolution of AI in Trade Finance

Read More News FlashiGTB Pulse Newsletter November 2024

Read More News FlashUAE’s National Bank of Fujairah (NBF) partners with Intellect for its eMACH.ai Cloud for Wholesale Banking on Microsoft Azure

Read Press Release News FlashSaudi Trade Finance Summit 2024

Know More

What can banks do to strengthen their balance sheets in these turbulent times?

Vishal is a banking & technology consultant and works as a Vice President – Solution Consulting for the Americas at iGTB. Over the past 17 years he has worked with banks and banking technology organizations performing varied roles of product manager, product owner, business analyst and implementation specialist. He has successfully led multiple design and delivery projects at many banks across geographies.

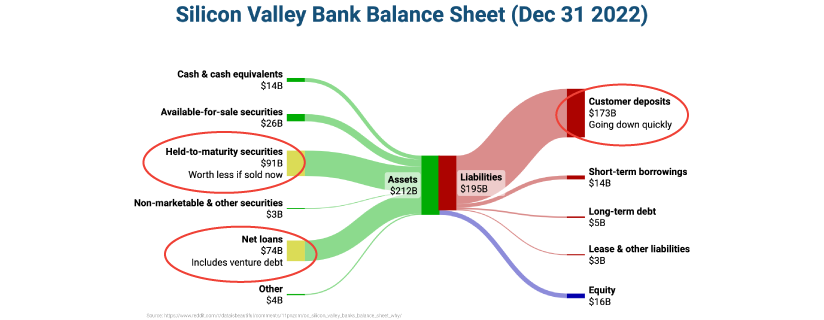

Between late 2019 and 2021, interest rates in North America were at historically low levels due to the Covid-19 pandemic. This had a negative impact on the banks' profits, and they were under pressure to seek out new ways of generating income, which led to some of the banks taking on more risky investments and lending practices.

In response to rising inflation, central banks then raised interest rates significantly starting early 2022, which further eroded the value of banks' held-to-maturity investments. These investments now have significantly lower value in the secondary markets, as better investing opportunities with better yields and similar risk profiles are available to the investors.

In today's digital age, one negative sentiment can trigger a large-scale withdrawal of funds, which can lead to a situation similar to that of Silicon Valley Bank. Although SVB had a huge deposit size to the tune of $120 Billion (as of 8th March 2023), customers withdrew $42 Billion in a single day from the bank, leaving it with $1 billion in negative cash balance, the bank had said in a regulatory filing. SVB’s bank run caused a ripple effect and massive withdrawals were observed at many other banks in the US.

Apart from the investment risks highlighted by the SVB crash, it emphasized again the need for banks to monitor the quality of their deposit portfolios – especially those from institutional and corporate clients. One of the most important indicators of quality of deposits is the split between balances linked to operational activities of the bank’s clients and non-operational balances held at the bank.

Operational balances refer to the funds that customers hold in their checking and current accounts with a bank to facilitate their daily financial transactions, such as paying bills, making purchases, and withdrawing cash. Customers ensure sufficient operational balances in their accounts to make sure their operations run smoothly. There is a certain stickiness that comes with these balances and they can therefore be categorized as of higher quality liabilities for the bank. These and other types of deposits (principally from retail and SME clients) are looked upon favourably through good internal governance and regulatory lenses, and can be used to fund loans and medium-term investments, which can generate stable income for the bank.

Non-operational balances are the funds that customers hold in their accounts with a bank for purposes other than their day-to-day financial transactions. These funds are typically regarded excess to current working capital needs, but may still sit in current account balances. Such deposits are less useful to a bank, and the bank may encourage the owner to term out or invest the funds – through the bank – into off-balance sheet instruments, such as money-market funds.

A clear target for the banks is to maximize the operational balances held by their customers. What are the levers that can help a bank to achieve this?

• Providing a contextual and feature-rich banking experience to their customers across the banking channels. The corporate online banking channel(s) of the banks must cover the breadth of cash management features. Features like self-serve, cash flow forecasting, ease of payments and reconciliation are some of the key differentiators for banks in this regard and act as encouragement for the customers to utilize a bank’s channel solution to support day-to-day operations.

• Tracking the operational balances held by the customers with the bank and offering the bank insights into the deposit mix and its direction of travel.

• Offering enhanced deposit pricing in terms of interest rates and earnings credits, for processing higher operational activities at the bank and maintaining higher stable balances to support these operations.

Over a period of time, these changes would result in attracting fresh deposits and improving stickiness of these deposits, thus strengthening the banks’ balance sheet.

Intellect Global Transaction Banking (iGTB) with its comprehensive and highly awarded suite of solutions has enabled banks across the globe to achieve exactly the same. The three tools relevant to the cause are:

• Contextual Banking Experience (CBX) - The online banking solution for corporations offers a comprehensive on-line banking experience to the customers, covering a multitude of intuitive user journeys.:

• Operational Account Manager (OPAC Manager) - OPAC Manager presents the banks with insights into their customers’ operational activities and helps in classification of the customer deposits, on a monthly or quarterly basis. The deposits classification may be done at account and/or relationship level.:

• Contextual Pricing (C-Pricing) - Contextual Pricing is a price adjudication utility that may be configured to automate delivery of enhanced pricing to the banks' customers based on multiple criteria, including but not limited to, customers’ risk profile, customers’ operational activities performed at the bank, the stable balances held by the customers, growth rate of the stable operational balances, client ESG ratings etc.

Interested in learning how iGTB can help you strengthen your bank and accelerate growth in transaction banking?

Talk to our experts to find out more about our offerings and services in this space

Schedule a brief session to address any questions or thoughts you may have.

Vishal is a banking & technology consultant and works as a Vice President – Solution Consulting for the Americas at iGTB. Over the past 17 years he has worked with banks and banking technology organizations performing varied roles of product manager, product owner, business analyst and implementation specialist. He has successfully led multiple design and delivery projects at many banks across geographies.