- What we do

-

-

Digital Engagement Banking

CBX is built to enable banks to run lean, experiment, and operate with speed and agility while focusing technology resources on innovation.

Products

Combining products for fulfilling holistic needs of the customer.

Platforms

Combining products, solutions and capabilities from multiple providers.

Banking As A Service

Embed services within a customer’s ecosystem, and reshaping consumption patterns of end customers.

-

-

-

- Company

-

- Knowledge

-

- Contact Us

News Flash

National Bank of Kuwait (NBK) expands partnership with Intellect Global Transaction Banking

Read Full PR News FlashiGTB's CTX Platform Successfully Deployed by a leading European Bank in France

Read Full PR News FlashiGTB Pulse Newsletter February 2024

Read More News FlashHighlights of Transformation Strategies for Transaction Banking in Philippines & Thailand

Know More News FlashThe Perfect Storm - Opportunities and Threats on the Horizon

Read More

Global Payments

Payments. Simplified.

An end to end solution for initiation, orchestration, execution and management of payments in a contextual, real time and API enabled ecosystem

0

+

Countries

0

+

Clients

0

+

Rails

iGTB’s Global Payments Hub

Get ahead of the Competition with Real -Time Global Payments Hub

Contextual Banking Experience (CBX)

To help corporate and SME clients originate payments on a rich contextual omni-channel platform

Payments Service Hub

Bulking, Debulking, Validation, Enrichment, Orchestration and PSR generation

ISO 20022 Remittance Data Management

That helps banks create a remittance repository and monetize the investment in iso20022

Contextual Payments Engine

Based on rules to give recommendations of cheapest and fastest rails and other AI/ML based recommendations for upsell and cross sell

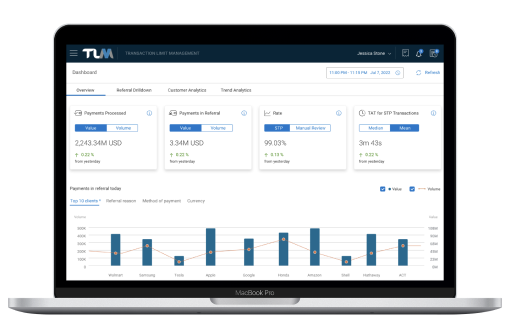

Transaction Limits Management

Real time payments exposure control across complex client account structures helping banks minimizes risk

Virtual Accounts and Liquidity Management

Pre-integrated with the payment's platform for a holistic digital transaction banking experience, to help banks offer POBO, COBO, receivables reconciliation, and other VAS

Explore solutions that can make you ready for today and the future

FedNow Payments

Transaction Limits Management

FedNow Payments

Unlock Real-Time Banking with iGTB’s FedNow Payment Solutions

Empowering Financial Institutions across the USA with 24/7/365 Instant Payments. Explore our innovative solutions, tailor-made for your bank’s business customers.

Learn MoreTransaction Limits Management

Real-time risk and limits management solution to optimize corporate liquidity and working capital

iGTB designed Transaction Limits Management (TLM), a system that processes corporate payments by checking client balances and limits in real-time and gives a pay/ no-pay/refer decision based on corporate cash and liquidity structures and shared limits thereby reducing limit breach risks while improving client experience and STP.

Learn More- Unified engagement hub that enhances channel experiences.

- Contextual, personalized interactions with insights and recommendations to initiate cross-border corporate payment

- Highly customizable dashboards using solution models that learns from historical behaviours basis recent transaction, currency, preferred accounts, payments rails and others

- Recommending the next best actions. Driving urgency and having payments executed immediately, upcoming payments notification in turn helps in managing the cash flow across accounts

- Friction-free seamless experience for business users, at scale for multiple personas such as product managers, operational manager, credit risk manager and others

- Thoughtful reference UX, supporting a spectrum of UI models to meet the needs of businesses of all sizes and verticals.

- 24x7x365 Instant Payments

- Support all real-time rails

- Instant authorization-settlement-notification

- Single view dashboard and CXO insights

- Trend, referral and exception analytics

- Customer/segment/product analytics

- Support for SWIFT MX, CBPR+ and ISO20022 formats

- Enhanced and structured remittance data

- Remittance repository, remittance API’s and monetization of remittance data

- Real-time visibility

- Transaction trend insights

- Business activity monitoring

- Payments-as-a-service

- Potential partner ecosystem of Fintech’s

See how Global Banks #winwithiGTB Trusted by the World’s Best

Client Testimonials

Explore testimonials showcasing how iGTB empowers 60% of the world’s top banks to #winwithiGTB

CIBC Is focused on innovation that makes a difference for our clients and leveraging IGTB's payments platform enhances our ability to deliver new capabilities, support emerging technologies such as blockchain, and positions us well to lead in the rapidly evolving payments market in Canada and the United States as they move towards real time payments

Phil Griffiths

SVP & Head of

Global Transaction Banking

Global Transaction Banking

CIBC Is focused on innovation that makes a difference for our clients and leveraging IGTB's payments platform enhances our ability to deliver new capabilities, support emerging technologies such as blockchain, and positions us well to lead in the rapidly evolving payments market in Canada and the United States as they move towards real time payments

Phil Griffiths

SVP & Head of

Global Transaction Banking

Global Transaction Banking

Composable, Contextual & Hyperscale Architecture

For High Resilience and Processing Large Volumes in Partnership with Microsoft Azure and AWS

Microservices Architecture

Loosely coupled, self contained services

API First

Build internal ecosystems with open APIs

100 % Cloud Native

Flexibility to deploy on any public cloud platforms

Pluggable Backends

Integrate any backend or application gracefully with pluggable integrations

Security

With layers of security, ready for public or private cloud deployment

No Vendor Lock In

Usage of open source components based on CNCF

Composable, Contextual & Hyperscale Architecture

For High Resilience and Processing Large Volumes in Partnership with Microsoft Azure and AWS

Microservices Architecture

Loosely coupled, self contained services

API First

Build internal ecosystems with open APIs

100 % Cloud Native

Flexibility to deploy on any public cloud platforms

Pluggable Backends

Integrate any backend or application gracefully with pluggable integrations

Security

With layers of security, ready for public or private cloud deployment

No Vendor Lock In

Usage of open source components based on CNCF

Composable, Contextual & Hyperscale Architecture

For High Resilience and Processing Large Volumes in Partnership with Microsoft Azure and AWS

Microservices Architecture

Loosely coupled, self contained services

API First

Build internal ecosystems with open APIs

100 % Cloud Native

Flexibility to deploy on any public cloud platforms

Pluggable Backends

Integrate any backend or application gracefully with pluggable integrations

Security

With layers of security, ready for public or private cloud deployment

No Vendor Lock In

Usage of open source components based on CNCF