- What we do

-

-

-

-

"Intellect’s continued dominance at the IBSi Sales League Table underscores its pioneering role in the fintech industry. Their commitment to innovation, exemplified by the groundbreaking eMACH.ai platform, continues to set a high benchmark in Retail Core Banking, Transaction Banking, and Lending. Intellect’s solutions are not only reshaping the present landscape but are also poised to lead the evolution of financial services globally, driving unprecedented advancements and customer-centric solutions."

Robin Amlôt

Managing Editor at IBS Intelligence

-

-

-

- Company

-

-

-

-

"Intellect’s continued dominance at the IBSi Sales League Table underscores its pioneering role in the fintech industry. Their commitment to innovation, exemplified by the groundbreaking eMACH.ai platform, continues to set a high benchmark in Retail Core Banking, Transaction Banking, and Lending. Intellect’s solutions are not only reshaping the present landscape but are also poised to lead the evolution of financial services globally, driving unprecedented advancements and customer-centric solutions."

Robin Amlôt

Managing Editor at IBS Intelligence

-

-

-

- Knowledge

-

- Our Events

- Contact Us

Africa Roundtable Event

Learn More News FlashiGTB Pulse Newsletter May 2025

Learn More News FlashHighlights of iGTB at EBAday 2025

Learn More News FlashEnhancing Corporate Payment Efficiency with SWIFT GPI Tracker powered by eMACH.ai

Learn More News FlashEmpower Digital Payments: KPI-Driven Payments with Self-Service Intelligence

Read More News FlashUnlocking Africa’s Trade Finance Potential: Driving Growth Through Digital Innovation

Read More

Intellect iGTB Payments Platform: Bringing Excellence in the Global Payments Landscape

Yusuf Bhanpurawala is a seasoned Product marketer with nearly 16 years of industry experience and a strong background in management. Throughout his career, he has had the privilege of working across a diverse range of industries, including Banking & Insurance, Communications, Manufacturing, Engineering services, Utilities and Geo-spatial. With a keen eye for industry trends and a knack for storytelling, Yusuf collaborates with subject matter experts and industry leaders to distil their knowledge and insights into thought-provoking articles, whitepapers, case studies, and Points of View.

Datos Insights impact report highlights iGTB Payments outstanding scalability, contextual experience, and cutting-edge cloud-native architecture.

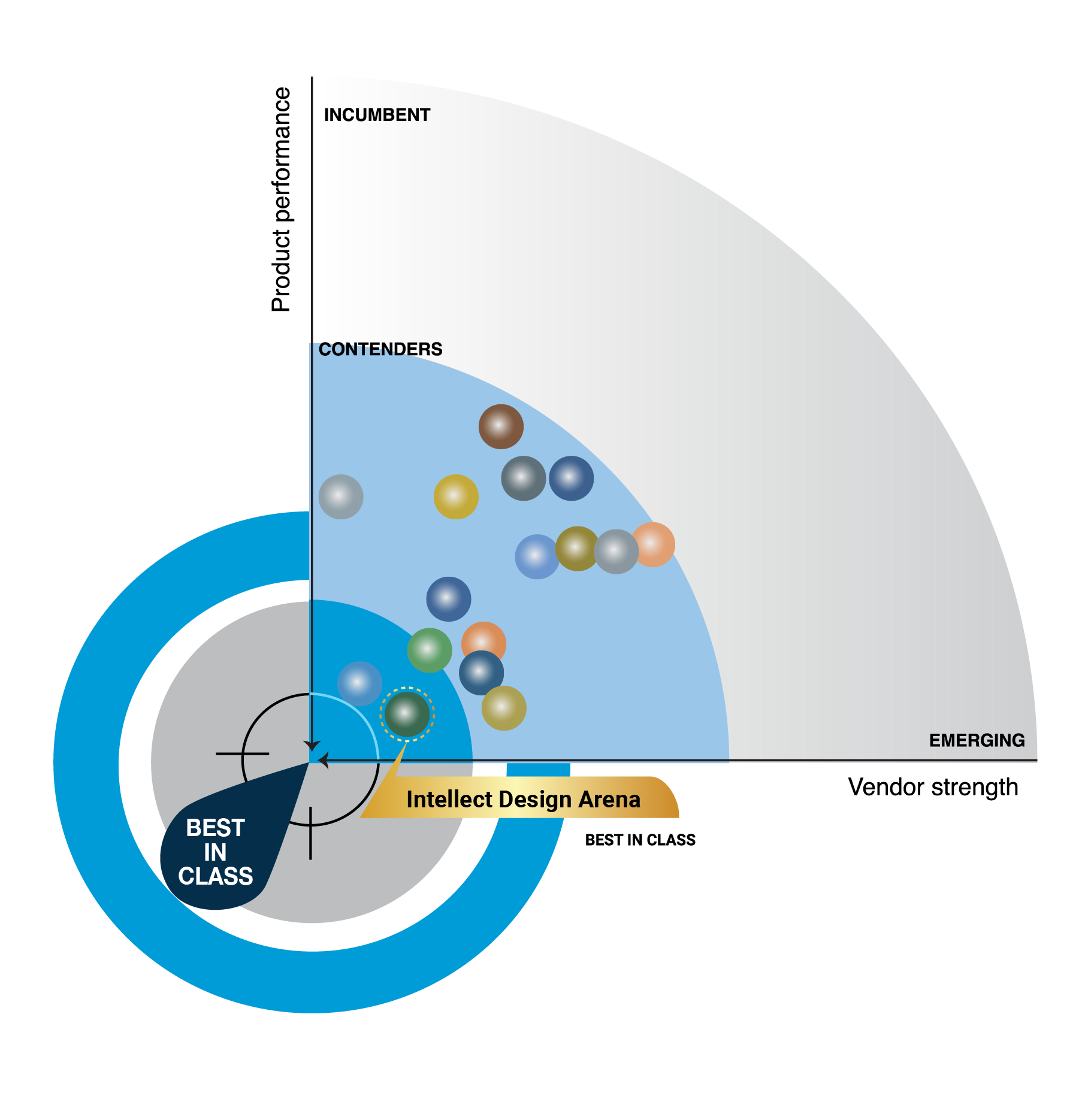

In the ever-evolving world of banking and finance, the importance of robust, adaptable, and innovative solutions cannot be overstated. Among the array of options available to financial institutions, Intellect's iGTB Payments platform stands out as a trailblazer, earning the prestigious title of 'Best-in-Class' in DATOS Insights Impact Report (formerly known as Aite-Novarica Group) . Renowned for its global scalability, contextual user experience, and distinctive microservices-based cloud-native architecture, Intellect's offering is transforming the way banks handle payments transactions.

The DATOS Insight Impact Report

Payment Hub Vendors: Options for banks to Modernize Payment Infrastructure

Erika Baumann, Director of Commercial Banking & Payments Practice at Datos Insights and the author of the report, has showered Intellect with accolades. In her words, "The Intellect platform is perceived as among the most advanced in the industry, with several clients citing thorough RFP processes and technical due diligence exercises before selecting the company." This rigorous evaluation process underscores Intellect's unwavering commitment to excellence.

Baumann further commends Intellect's remarkable resilience demonstrated during the challenges posed by the COVID-19 pandemic. Even with increased resource demands, Intellect maintained service levels without a hitch. The firm's high-caliber management, commitment to SLAs, and strict adherence to key performance indicators have left an indelible mark on the industry. As a result of its comprehensive evaluation across multiple criteria, Intellect has rightfully claimed its place as a market leader.

The report further elaborates how iGTB Payments excels in various aspects, making it a standout choice. Its robust functionality and user-friendly interface position it at the top of the stack, and iGTB Payments un-questionably shines. Based on the analyst’s rigorous evaluation, it becomes evident that Intellect's strengths are deeply rooted in its proven track record, particularly with FI’s of all sizes. These institutions have consistently found a reliable partner in iGTB, a stark contrast to the challenges they faced with larger, US-centric vendors. The ability to understand local markets and navigate their intricacies is a pivotal advantage, especially for banks operating beyond the United States.

The report commends iGTB Payments prowess in supporting multiple payment rails, as not every vendor can claim such comprehensive coverage. The company's robust APIs and unwavering customer support stand out in the industry. It further states that Intellects support levels, technical engagement and upper management engagement are highly regarded by clients.

iGTB Payments cloud capabilities align seamlessly with the evolving market trends, making it a forward-thinking choice. Additionally, the company's stability, client strength, service quality, and product features set an impressive standard. While no one is flawless in every aspect, Intellect comes remarkably close. Notably, their profound understanding of non-US markets is a distinctive strength. Their localized approach guides customers through the dynamic landscape of financial changes. Moreover, Intellect's modern user interfaces, devoid of cumbersome designs, enhance efficiency and usability. The implementation of a headless architecture on the payments channel is another boon, offering both flexibility and performance. In summary, Intellect's well-rounded and forward-looking approach makes it a compelling choice for institutions seeking excellence in their financial solutions.

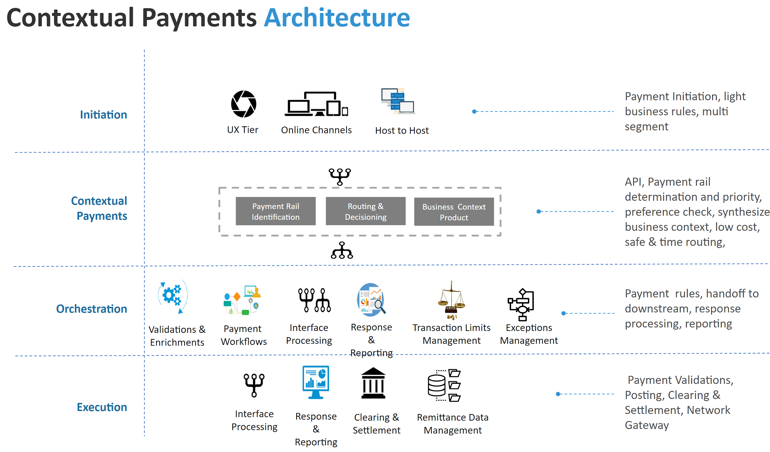

Revolutionizing the Payments Ecosystem

Intellect iGTB's Payments platform is meticulously designed to manage the entire payments lifecycle, from initiation and pre-processing to real-time execution, clearing, and settlement. What truly sets iGTB Payments apart is its innovative contextual approach to payments, ensuring that every click anticipates and fulfils end-user needs.

The Intellect iGTB Payments suite comprises the Payments Services Hub, Contextual Banking Experience for business users, a Transaction Limits Management for real-time payment decision-making and a Remittance Data Management module to create a remittance repository of structured enhanced remittance information . The solution seamlessly integrates with Virtual Accounts, delivering unparalleled value to banks and their customers worldwide.

Strengths that Define iGTB Payments

The report spotlights several strengths that define Intellect's Payments platform:

● Contextual and Intuitive Navigation: Intellect's user interface is meticulously crafted to offer a seamless and intuitive navigation experience, catering to users' preferences and needs.

● Microservices - Based Cloud-Native Architecture: This architecture empowers banks to seamlessly integrate the solution into their existing platforms, offering unparalleled flexibility and scalability.

● Dual Operating Modes: Intellect provides two distinct modes of operation - an expert mode tailored for banks needing minimal assistance and a simplified mode ideal for small and midsize banks seeking more guidance.

● Comprehensive Functionality: The platform leaves no functionality gaps and unlike other vendors, includes certain niche modules such as TLM for funds control, Remittance Data Management for ISO20022 remittance data and CPE – Contextual Payments Engine for recommendations of the optimum ( least cost, fastest time) rails..

Evaluation by the Datos Insights Matrix Report

The Datos Insights Matrix Report meticulously evaluated some of the key vendors in the space that includes, ACI Worldwide, Alacriti, Bottomline Technologies, CGI Inc., Finastra, FIS, Fiserv Inc., IBM, Icon Solutions, Infosys Finacle, Oracle, Pelican AI, Tietoevry, and Volante Technologies among which iGTB Payments out performs across various dimensions:

Client Strength: Intellect leads the industry with its diverse customer base, high customer retention rates, and strong client recommendations.

Client Service: The company excels in support, training, issue resolution time, and delivery procedures.

Vendor Stability: Intellect stands out as one of the few leaders in this category, boasting clients with high retention rates.

Product Features: Intellect is recognized as one of the top two leaders, offering comprehensive support for all payment types and ISO 20022 and MX messaging.

Scale and Success

To underscore its global reach and success, Intellect iGTB Payments boasts an impressive track record:

With Intellect's iGTB Payments platform, banks can unlock unparalleled efficiency, scalability, and customer satisfaction in their payment processing operations. This solution heralds a new era in banking technology and should be at the forefront of consideration for financial institutions worldwide.

To download the full report:👉 Click Here

Yusuf Bhanpurawala is a seasoned Product marketer with nearly 16 years of industry experience and a strong background in management. Throughout his career, he has had the privilege of working across a diverse range of industries, including Banking & Insurance, Communications, Manufacturing, Engineering services, Utilities and Geo-spatial. With a keen eye for industry trends and a knack for storytelling, Yusuf collaborates with subject matter experts and industry leaders to distil their knowledge and insights into thought-provoking articles, whitepapers, case studies, and Points of View.

Perspectives

What is BaaS and how does it add value to banks and their corporate customers?

Intellect Global Transaction Banking (iGTB) identified as a leader and "Best in Class" Payments Platform provider

Fifth Third Bank launches cloud-native self-service user experience