- What we do

-

-

-

-

"Intellect’s continued dominance at the IBSi Sales League Table underscores its pioneering role in the fintech industry. Their commitment to innovation, exemplified by the groundbreaking eMACH.ai platform, continues to set a high benchmark in Retail Core Banking, Transaction Banking, and Lending. Intellect’s solutions are not only reshaping the present landscape but are also poised to lead the evolution of financial services globally, driving unprecedented advancements and customer-centric solutions."

Robin Amlôt

Managing Editor at IBS Intelligence

-

-

-

- Company

-

-

-

-

"Intellect’s continued dominance at the IBSi Sales League Table underscores its pioneering role in the fintech industry. Their commitment to innovation, exemplified by the groundbreaking eMACH.ai platform, continues to set a high benchmark in Retail Core Banking, Transaction Banking, and Lending. Intellect’s solutions are not only reshaping the present landscape but are also poised to lead the evolution of financial services globally, driving unprecedented advancements and customer-centric solutions."

Robin Amlôt

Managing Editor at IBS Intelligence

-

-

-

- Knowledge

-

- Our Events

- Contact Us

Your Blueprint to Payment Modernization – Omdia Universe Payments Hub report 2024

Read More News FlashThe Evolution of AI in Trade Finance

Read More News FlashiGTB Pulse Newsletter November 2024

Read More News FlashUAE’s National Bank of Fujairah (NBF) partners with Intellect for its eMACH.ai Cloud for Wholesale Banking on Microsoft Azure

Read Press Release News FlashSaudi Trade Finance Summit 2024

Know More

Consumerisation Of Commercial Banking

Offer your corporate clients the immense possibilities by reorienting the end-user's experience

A Single Global Ecosystem of Consumerisation

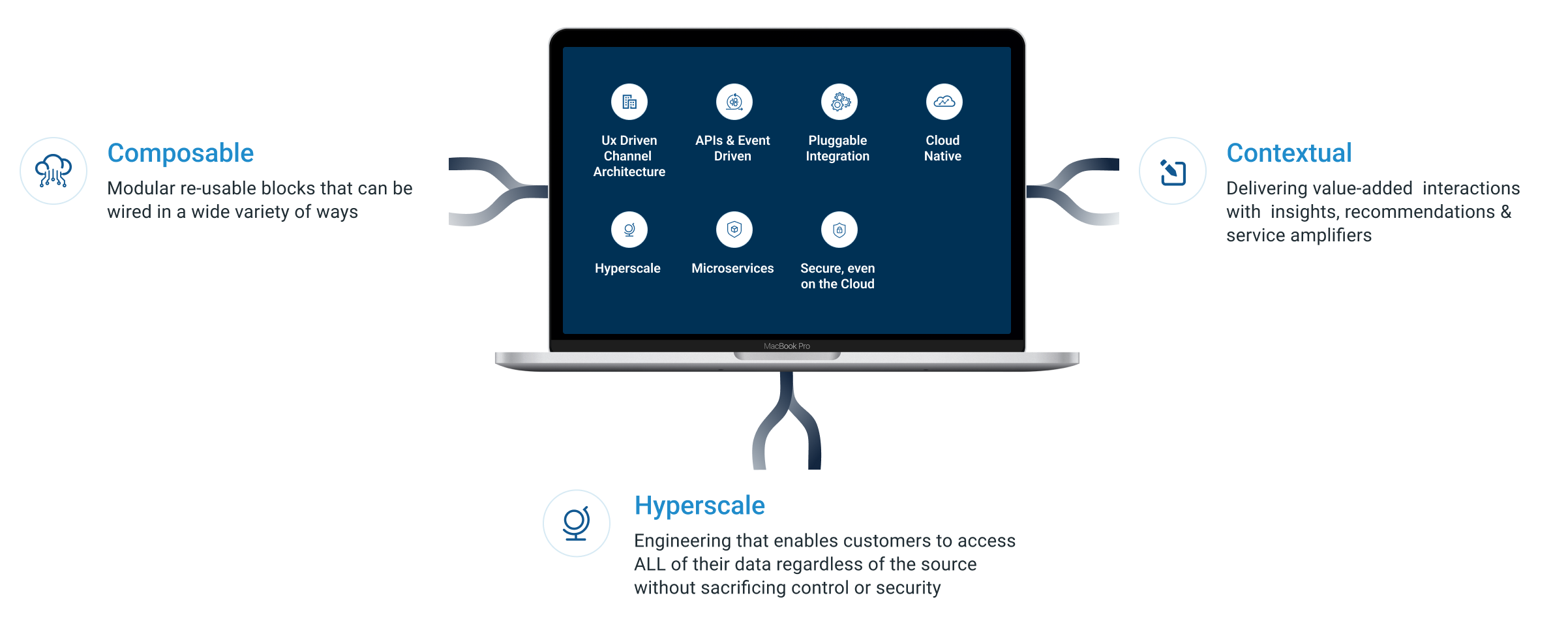

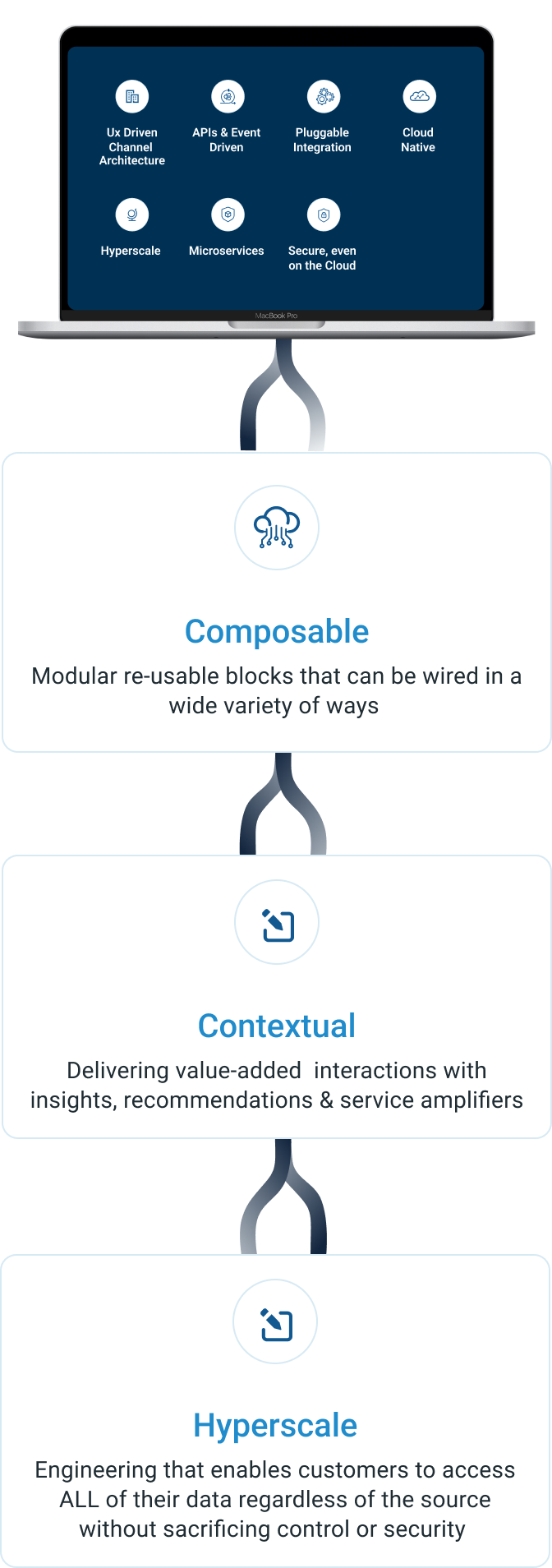

The most comprehensive, composable and contextual open finance platform with domain and technology embedded

Learn More

Explore Consumerisation

Consumerisation is the specific impact that consumer-originated technologies can have on commercial banking. It reflects how advantage of, enterprises and banks will be affected by, and can take new technologies and models that originate and develop in the consumer space.

Embrace the Technology that Delivers

Consumerization of Commercial Banking

Modular re-usable blocks that can be wired in a wide variety of ways.

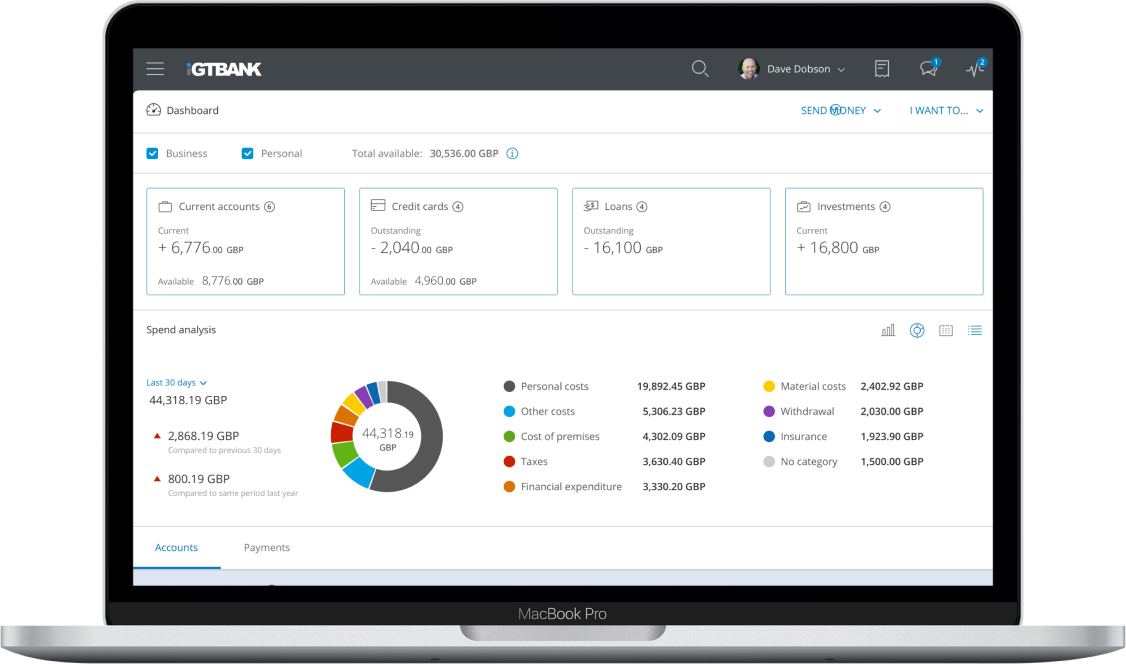

Account services’ data & dashboards can be composed differently for different client segments (large

corporate & small business).

Delivering value-added interactions with insights, recommendations & service amplifiers that yields “next-best-action” or “next-best-offer”.

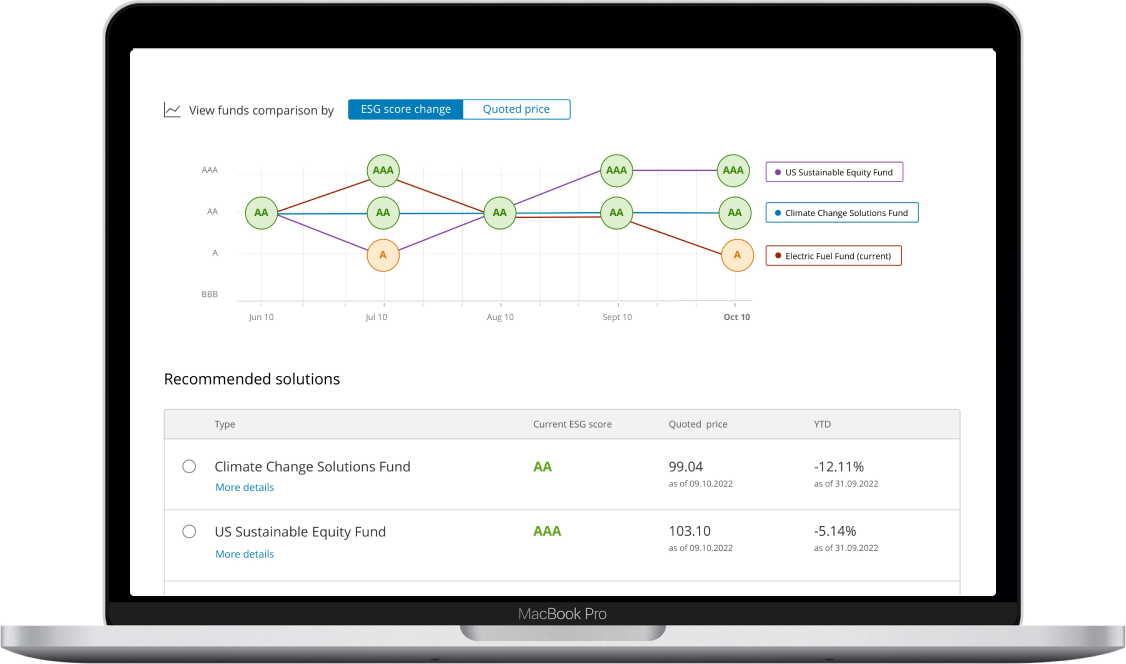

Recognize events in real-time, linked to system intelligence and instantly propose next-best preventive action (in case of low ESG score of investments) or maximize revenue (intuitive cross-sell offers to clients)

Engineering that enables customers to access ALL of their data regardless of the source without sacrificing control or security

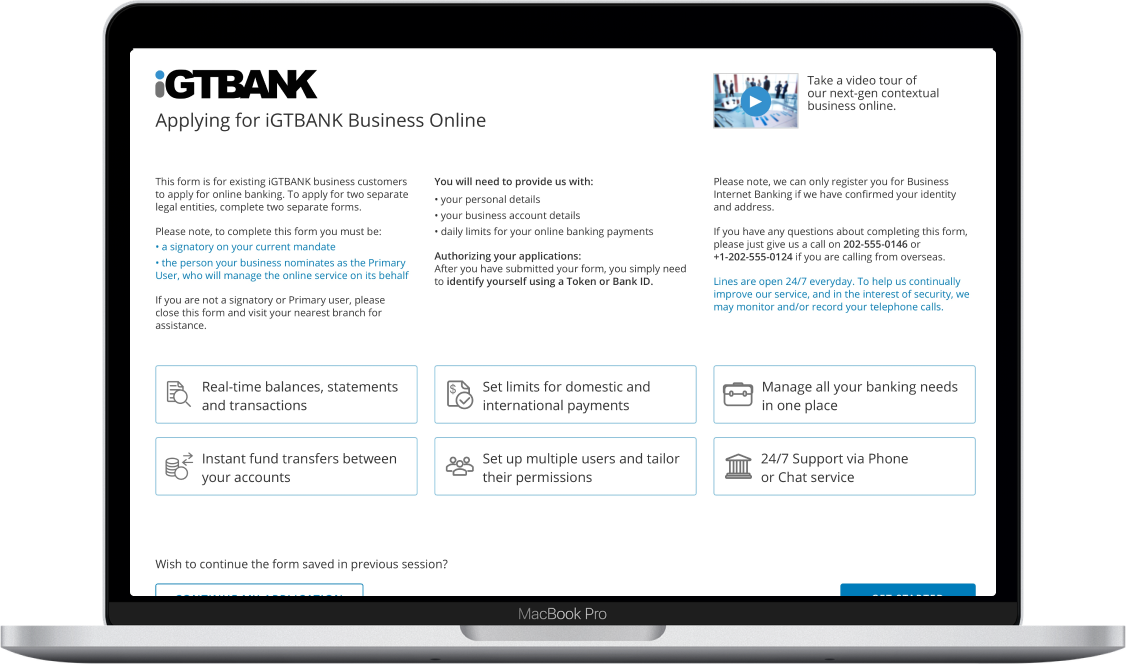

Stepping into a high volume segment like business banking is catered to with the help of guided technology using AI and UX to enable self-onboarding at scale.

A Single Global Ecosystem Of Consumerisation

A single global ecosystem of consumerisation for liquidity, investments, deposits, cash management, payments, virtual accounts, trade and supply chain finance powered by Commercial Banking Operating System (CBOS)

Contextual Products

Offering sharply differentiated set of products with context as the driver.

Solutions

Combining products for fulfilling holistic needs of the customer.

Platform

Combining products, solutions and capabilities from multiple providers.

Banking as a Service

Embed services within a customer’s ecosystem, and reshaping consumption patterns of end customers.

Commercial Banking Operating System (CBOS)

In this innovative quest, iGTB has built an umbrella of differentiated architecture, technology and composable, offerings which we term as Commercial Banking Operating System .

Commercial Banking OS is built for the cloud. This hyperscale technology stack is the basis of composability and contextuality when it comes to building – a robust engine. A technology engine that is architected to deliver high performance, that can easily scale up, cater to the high transaction growth demands of corporates and is highly efficient in corporate banking operations.

DNA OF Intellect

#GLOBAL

Build to be global

#ACTIVE

Live & Realtime

#DIGITAL

Consumer First Tech

iGTB Oxford

iGTB Oxford World’s only School of Transaction Banking

What Our Leaders Say

The Consumerisation of commercial banking

Commercial Banking is on the cusp of fundamental shifts that will dramatically reorder the industry in the coming decade.

Uppili Srinivasan, President, Business Head for Digital, Payments and Liquidity

In conversation with Paul Hindle, Editor of Fintech Futures on Consumerisation of Commercial Banking.

Knowledge Centre

Survival Strategy with Supply Chain Finance

What may previously have been regarded as a dream – paperless trade – is now a reality. Get the Whitepaper to know more

Aite-Novarica Innovation in Cash and Liquidity Management

Aite Novarica Innovation in Cash and Liquidity Management Learn how BNY Mellon leveraged Intellect iGTB’s capabilities

Aite Payments Matrix Report

Intellect Global Transaction Banking (iGTB) identified as a leader and "Best in Class" Payments Platform provider

Talk to our team of experts to learn how we can accelerate your banking transformation journey

- CBX for Business & Corporate Banking

- Digital Transaction Banking

- Corporate Treasury Exchange

- Corporate Payments

- Virtual Accounts Management

- Trade & Supply Chain Finance

- iColumbus.ai

- iGTB Cloud

- Banking as a Service (Baas)

Talk to our team of experts to learn how we can accelerate your banking transformation journey

- CBX for Business & Corporate Banking

- Digital Transaction Banking

- Corporate Treasury Exchange

- Corporate Payments

- Virtual Accounts Management

- Trade & Supply Chain Finance

- iColumbus.ai

- iGTB Cloud

- Banking as a Service (Baas)